Financing Scheme Set Up#

To enlarge any images in this document, right click on the image and open in a new tab.

Platform provides a Financier with the ability to setup and configure a Finance Scheme. Three Finance Schemes are supported on the platform, they include

- Reverse Factoring

- Factoring

- Discounting

Configuring Reverse Factoring Finance Scheme#

Reverse Factoring Financing is a purchaser centric finance scheme. Reverse Factoring scheme, links Financier, Purchaser and Suppliers together into the one finance scheme. Financier will process and approve early payment requests from a supplier, whose invoices have been approved by the purchaser.

On maturity, purchaser will pay the full invoice amount, of which the financed amount, accrued interest will be repaid to the financier. Platform fees will be deducted and credited to LilardiaCapital, all other residual monies will be credited to the supplier. All required payment instructions are generated by the platform.

Financier needs to allocate two bank accounts for a Reverse Factoring Finance scheme, one to handle payments to suppliers, one to handle collections.

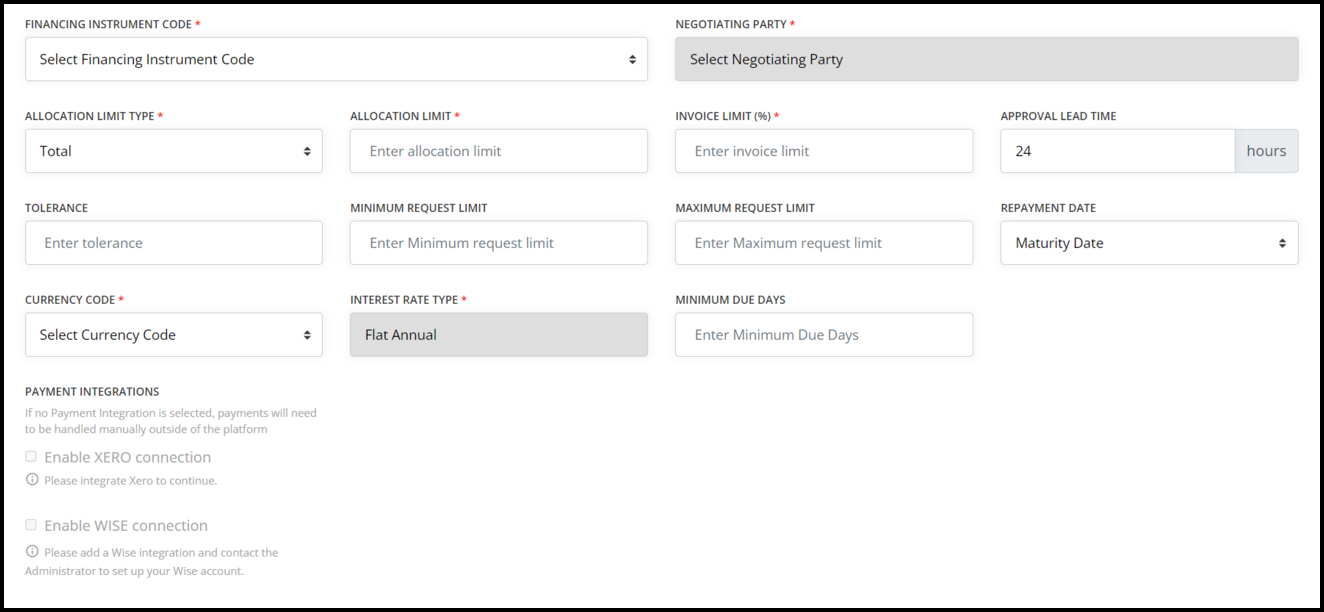

To create a reverse factoring finance scheme, click on Financing (Fig 1), click on financing Schemes and click on Add Financing Scheme, then you will be navigated to Fig 2.

Fig 1 - Financing

Fig 2 - Add Scheme

Configuring Factoring Finance Scheme#

Factoring is a supplier centric finance scheme. Financiers, Purchasers and Suppliers participate in Factoring Finance Scheme

Financier will fund early payment invoice request made by the supplier. Purchaser must approve these invoices, prior to supplier submitting them for financing.

On maturity, Purchaser will pay the full invoice amount to a dedicated Direct Deposit Account (DDA) in the name of the financier but managed by LC. Funded amount, interest accrued will be repaid to the Financier. Platform fees will be deducted and credited to LC. All remaining monies will be credited to the supplier.

Platform will generate all required payment instructions.

Financier is required to create at least one dedicated bank account for the purpose of handling all platform related transactions. This account is referred to as the Dedicated Deposit Account (DDA).

To create a financing scheme based on factoring, follow the same steps followed in the reverse factoring to navigate to add financing scheme.

- Financing Instrument Code = Factoring

- Dedicated Deposit Account = Select your DDA account

Configuring Discounting Scheme#

Discounting Finance Scheme is a supplier centric finance scheme, where only the supplier and financiers participate. Financier allocates a facility amount for a selected supplier, who would then submit invoices as collateral to request early payment. Financiers approve and pay the early payment request amount to the supplier.

On maturity, supplier repays the outstanding amount, plus any interest that has accrued to the financier. Supplier would also pay any associated platform fees to LC.

Financier needs to set up a dedicated bank account for the purpose of handling all transactions related to this scheme.

To create a financing scheme based on discounting, follow the same steps followed in the reverse factoring to navigate to add financing scheme.

- Financing Instrument Code = Discounting

- Dedicated Deposit Account = Select your DDA account

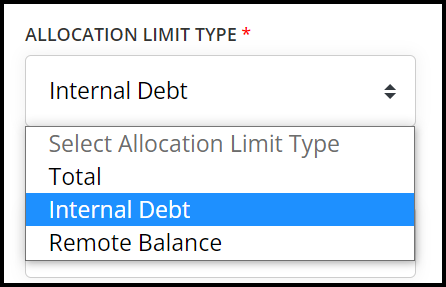

Allocation Limit Types:#

Platform supports three types of Allocation Limits within a Finance Scheme, they being

- Total

- Internal Debt

- Remote Balance

Fig 1 - Allocation Limit Type

Total#

If Total is selected, the platform will reduce approved Finance Request amount from the original Limit set. Once the limit is exhausted, platform will not allow any further Finance Requests.

Internal Debt#

Internal Debt option nets off repayment amount once the repayment is received by the platform, releasing the repayment funds for future use. Suppliers can then submit new invoices for financing, utilising the monies that have been repaid.

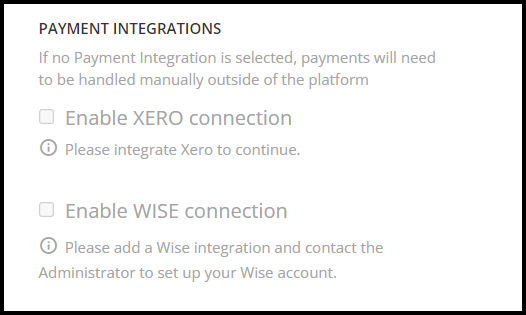

Payments Integrations#

Platform support two types of Payment Intgrations within a Finance Scheme,

- XERO

- WISE

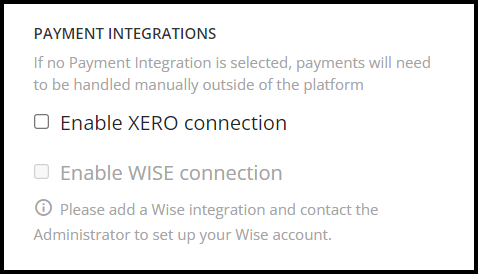

Fig 1 shows the Payment Integrations before financier integrate Wise and Xero to the platform.

Fig 1 - Payement Integrations

Xero#

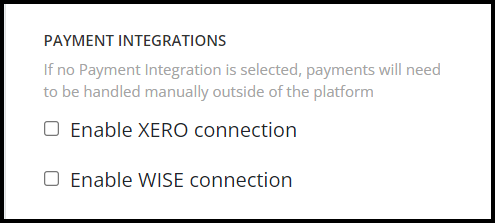

Once financier integrated Xero to the platform it will displayed as Fig 2. The financier can enable the Xero connection by clicking on the checkbox.

Fig 2 - Xero Integrated to the platform

Wise#

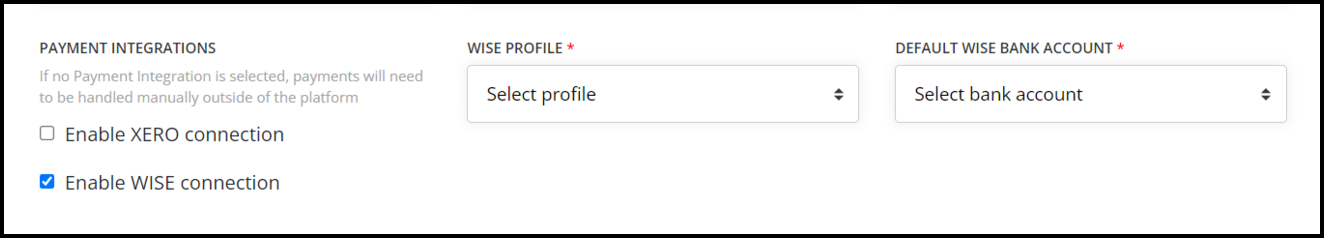

After financier integrated Xero and Wise to the platform it will displayed as Fig 3. A financier will then be able to enable both Xero and Wise connections from the Financing Scheme.

Fig 3 - Xero and Wise Integrated to the platform

Click on the check box to enable Wise Connection and two new dropdowns will appear to select Wise Profile and Default Wise Bank Account as shown in Fig 4.

Fig 4 - Enabled Wise Connection

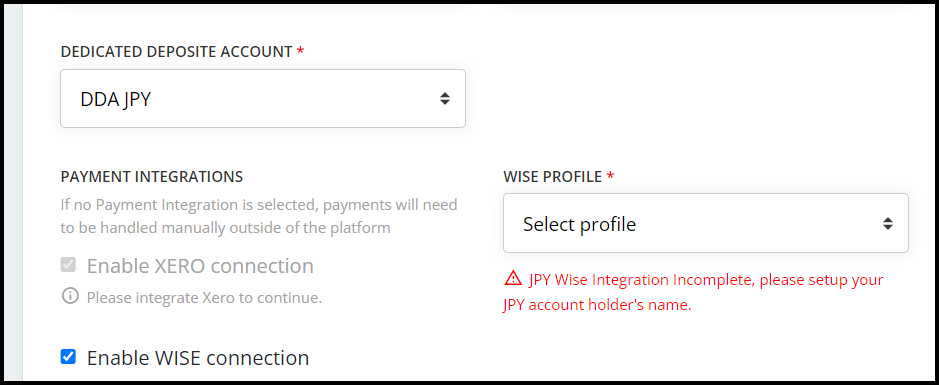

If Wise connection is enabled for the JPY Financing scheme and JPY account holder's name is not configured for the integrated wise account, the Wise profile field will display as shown in Fig 5.

Fig 5 - JPY Wise Integration Incompletes

To configure the JPY account holder's name first log in to your Wise account and click on the 'Send Money' option (Fig 6).

Fig 6 - Send Money Option

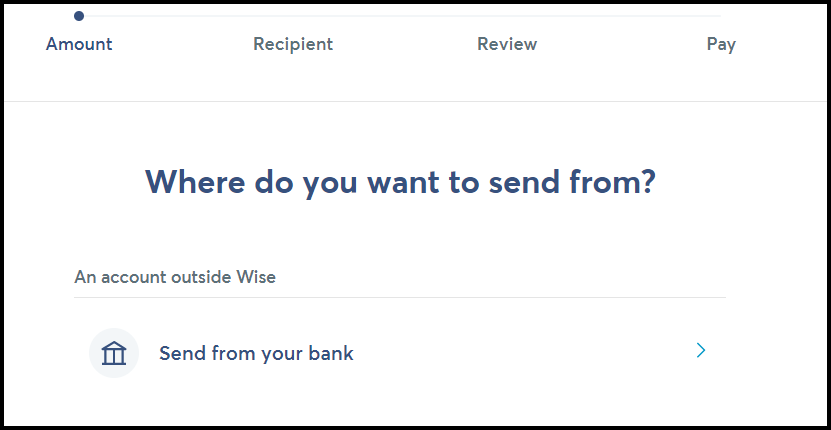

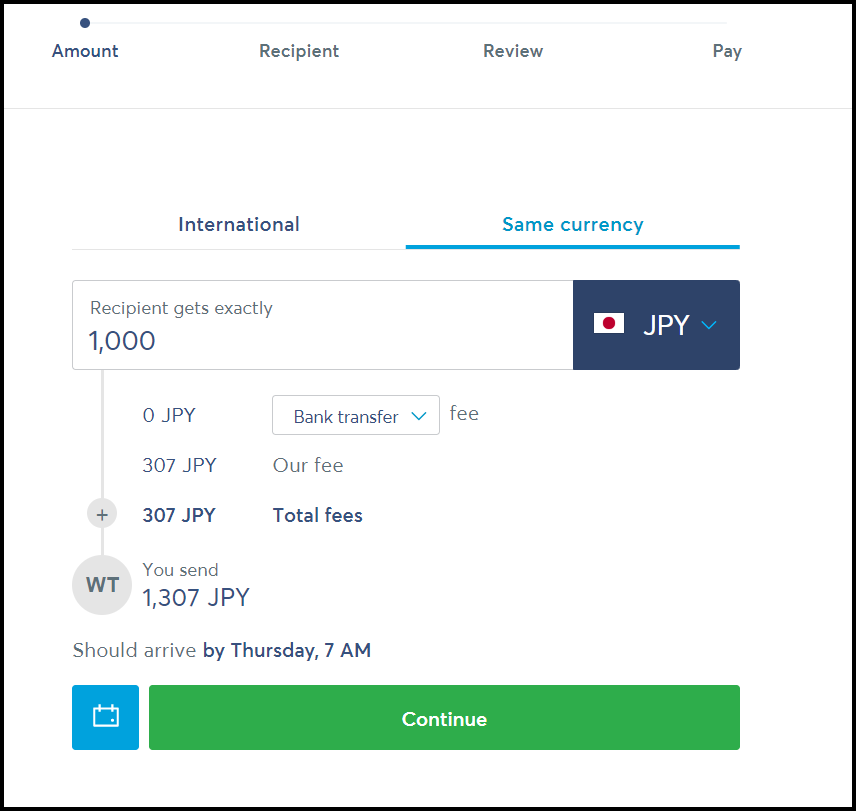

Then select the 'Send From Your Bank Account' option (Fig 7) and select currency as 'JPY' and click the 'Continue' button (Fig 8), then Fig 9 will appear.

Fig 7 - Send From the Bank Account

Fig 8 - Select the Currency

Fig 9 - Select Wise Profile

Select the correct profile from the above screen and then Fig 10 will appear. This is where you need to configure the JPY account holder's name.

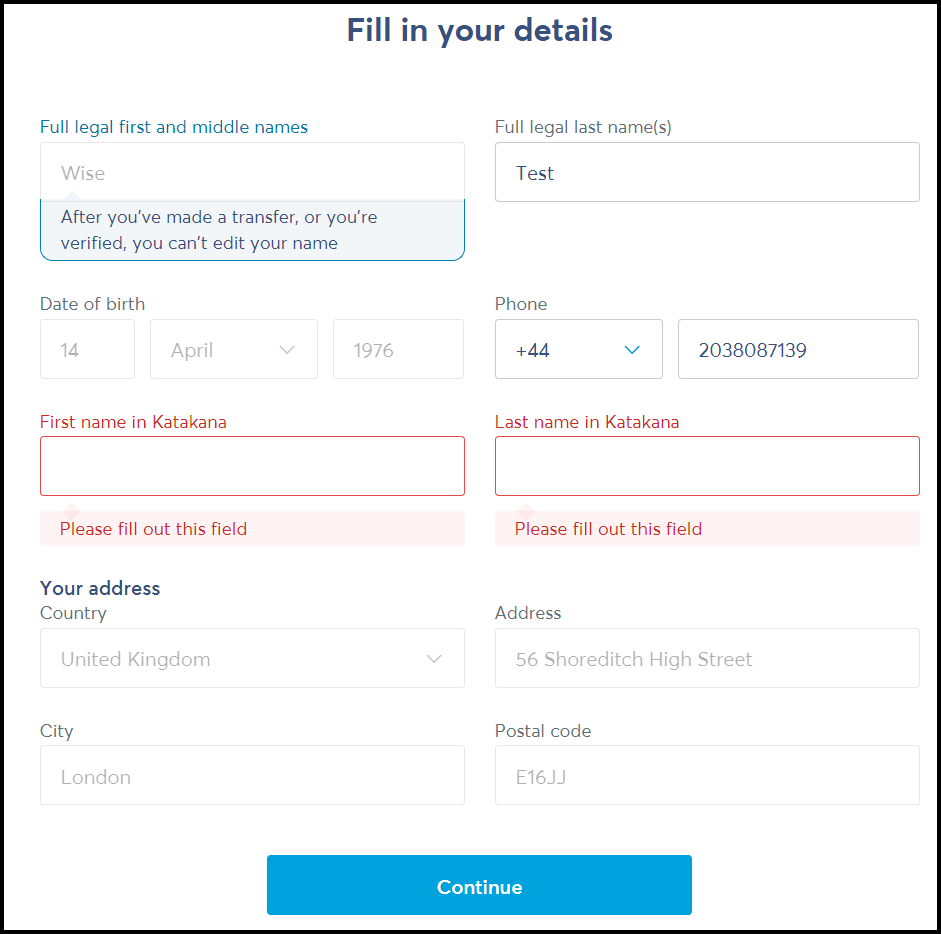

Fig 10 - Set the First and Last name in Katakana

Enter the First name and Last name in Katakana and click on the 'Continue' button. Once the JPY configuration is complete, the Wise profile will be available to select for the JPY financing scheme.

Configuring Maximum Credit Limit and Credit Tier#

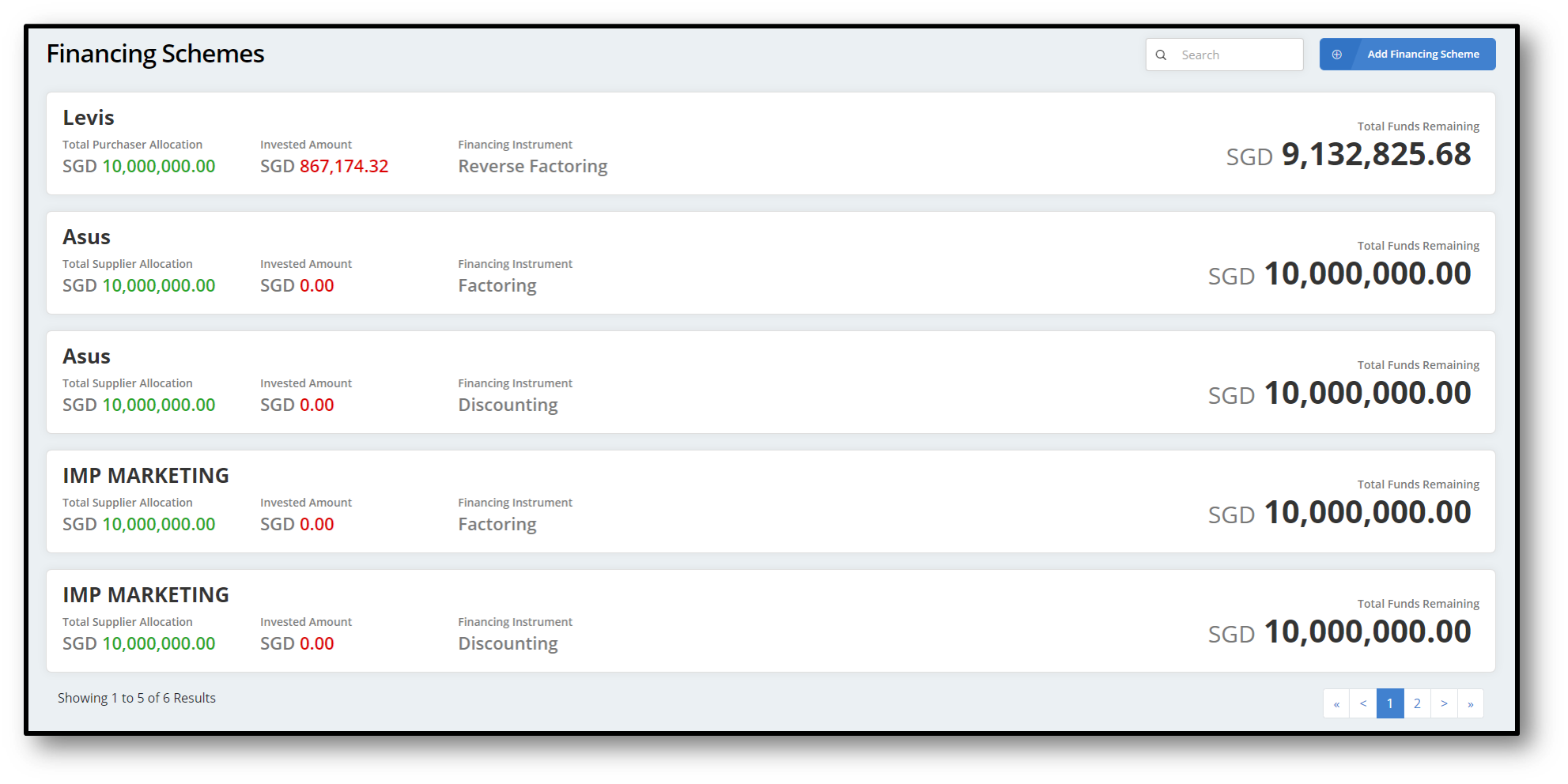

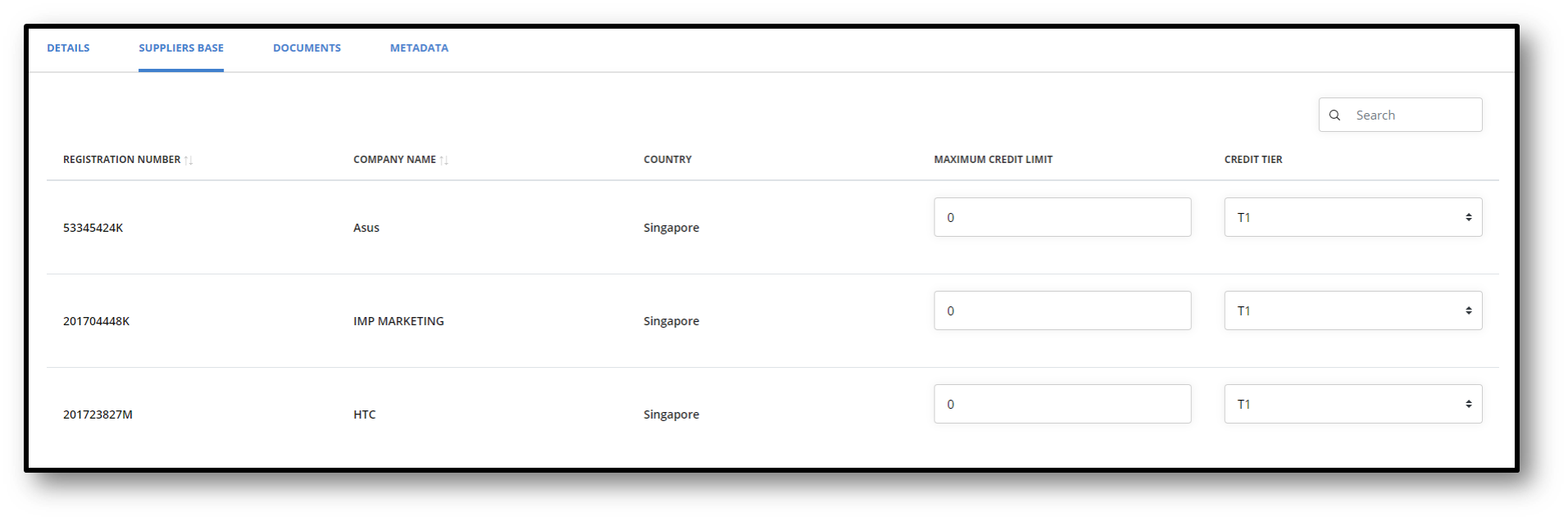

To set maximum credit limit and a credit tier for each purchaser/ supplier. Click on a financing scheme and click on supplier/ purchaser base tab then Fig 2 will be displayed.

Fig 1 - Financing Schemes

Fig 2 - Supplier/ Purchaser Base

-

Maximum Credit Limit = Total allocated amount for individual supplier/ purchaser. Once the limit has exceeded that supplier cannot request financing.

-

Credit Tier = All available tiers for the particular financing scheme.